Contents:

Bookkeepers and Accountants usually communicate and work together to give you the best outcomes and to keep the records accurate. Afterwards, reports can be produced that show the affect of all the money coming in and going out. Each transaction has a financial component so once this amount is known it is ready to be recorded.

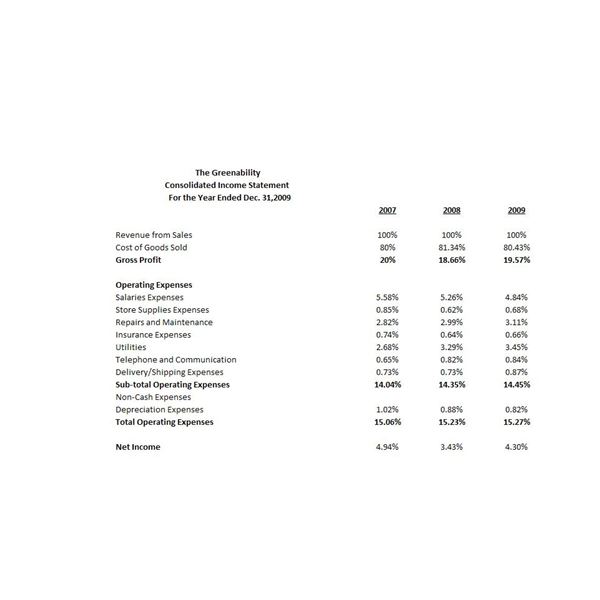

Another reason is that there are two types of Income Statement – cash and accrual. If you want to know how much is in the Bank account – don’t look at the Income Statement. Here is a list of basic activities that you might do which have a financial component. Either way, it’s a learning curve and you should be prepared to put in extra time at the beginning whilst you are figuring it all out. I do recommend at least being able to prepare or access an Income Statement every month so that you know if your hard work is profitable or not. If it’s not profitable, you must make decisions to improve this.

Self-Employed Bookkeeping Example

After all of that testing, I landed on these eight apps as the best accounting software for freelancers. All organisations accumulate huge volumes of transactions every month, including sales, purchases, payroll, bill payments, and so on. A bookkeeper will record and process all of these transactions, making it easier for their organisation’s accountant to make their official financial statements.

What Is Bookkeeping? Questions To Ask Before You Get Started – Forbes

What Is Bookkeeping? Questions To Ask Before You Get Started.

Posted: Mon, 05 Dec 2022 08:00:00 GMT [source]

Being a self-employed bookkeeper can allow you to utilise your head for numbers while gaining more control of how and when you work –– and whom you work for. Whether you’re a seasoned bookkeeper looking to branch out on your own or just starting your career, this guide will help you get started. The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed. We’ve collected 23 of the top bookkeeping templates for small business owners.

Can I Compete my own Bookkeeping?

We’ll tell you some of the things you’ll need to know, and help you decide whether this work is for you. Her writing has also appeared in NewsWeek and Huffington Post. Below is a sample bookkeeper job description that you can customize to meet the needs of your business.

Luckily, the knowledge base is pretty thorough, so you can tab out from time to time to figure things out. The user interface is bright and tidy, with some quotes about life and business to shake up your day. The onboarding is fast, as QuickBooks only wants to know your industry to give you some advice on expenses folks in your industry usually write off. From then on, you’ll have a set of messages on the dashboard to help you set everything up, from adding your business details to checking whether you’re married or not . Wave lets you attach your receipts to expenses, so you have everything in one place, but it won’t extract data for you—you’ll have to input it manually.

moving your bookkeeping from manual records to software

Customer Stories See how our customers are building and benefiting. Financial services Move faster, scale quickly, and improve efficiency. Project management Plan projects, automate workflows, and align teams.

The trade discount interface has a lot of open space, showing the preview of every document as you’re filling it out. And you can access reports directly on the Insights tab, showing relevant stats like net income, time worked, and your true hourly rate. The cash flow page has some useful details, including predictions about your financial future. It suggests actions you can take to keep your finances sharp, such as nudging clients to pay invoices, taking care of your bills, and viewing the status of your bank accounts. Other features of note are sales tax handling and a deep accounting section with your entire chart of accounts.

Social media marketing tips for accountants

Get a snapshot of your monthly profit and loss report by entering your financial data and selecting the month that you want to view in the dashboard. All FreeAgent bookkeeper partners have a dedicated dashboard that provides a unique snapshot of all of their clients, along with the option to drill down to manage individual clients in detail. Once a month from about 20th to 30th, after your receipts, payments and bank accounts mentioned above are all entered and reconciled for the prior month, look at your business reports . Once a month on about the 5th, email Customer Statements to your customers to show them what Invoices or amounts are outstanding – include a reminder of due date of payment. Or alternatively re-send them the invoice by itself with a gentle reminder that it is due now if the Customer is late in paying.

When the business starts to grow, they are quick to transfer the responsibility to a professional bookkeeper. Some don’t even venture into it from the start, they feel it’s too tedious and time-consuming. Don’t get it wrong, some businesses are actively using these online tools on a long-term basis, however, you’ll find many companies willing to hire a professional bookkeeper.

FreeAgent accepts your receipts as attachments to bills or expenses, and if you use the mobile app, it’ll extract data using OCR feature. These types of payments can add up to a lot of money that’s gone out the bank account that is not accounted for on the Income Statement . As soon as you receive a customer payment by check or cash, mark it off against the invoice and deposit it to the bank account so that it doesn’t get lost and so your cash flow is good. As soon as your job for a customer is finished, prepare and send the invoice – make sure to include any costs involved . If you have not received some of the bills yet, then wait until they are all in before invoicing your customer, so nothing is left off the invoice.

Starting a bookkeeping business

The hourly rate ranges from $26.91 in Louisiana to $43.57 in Massachusetts. Meanwhile, the average hourly wage for in-house bookkeepers is approximately $21.10, ranging from $26.85 in Washington to $16.55 in North Carolina. Bookkeeping for the Self-employed can be done in various ways, but using online accounting software is the most efficient way to keep track of your transactions. It’s essential to keep track of all your business expenses throughout the year, as this will make it easier to file your tax return.

Patricia Tice Obituary (2023) – Linden, MI – Flint Journal – Grand Rapids Press Obituaries

Patricia Tice Obituary ( – Linden, MI – Flint Journal.

Posted: Thu, 20 Apr 2023 19:30:32 GMT [source]

It also has some useful extra features, including Wave Checkouts, which allows you to accept payments from your website with a payment link. I can’t justify an accountant, and a lot of businesses my size can’t. Being able to get real-time information on how much I owed in taxes, I love that.

However, freelance bookkeepers may have more control over their pricing and may charge higher rates because of their specialized skills or expertise. Overall, there’s no clear answer since income will vary based on individual circumstances. Some of the providers offer a plan for self-employed accounting software. It can prepare all the figures for the self-assessment tax return and track mileage and time. Communication tools like Zoom or Google Meet combined with instant messaging apps and modern accounting software like Countingup all contribute to making virtual bookkeeping possible. That’s because virtual bookkeepers can maintain the crucial human element of their businesses without in-person meetings.

These websites connect professionals of every niche and industry with clients who need their services. Bookkeeping or accounting software to make life easier for you and your clients, such as Countingup. Use this balance sheet template to report your business assets, liabilities, and equity.

Patricia Lou Tice Obituaries tctimes.com – Tri-County Times

Patricia Lou Tice Obituaries tctimes.com.

Posted: Thu, 20 Apr 2023 19:01:00 GMT [source]

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time.Try Smartsheet for free, today. Enterprise See how you can align global teams, build and scale business-driven solutions, and enable IT to manage risk and maintain compliance on the platform for dynamic work. Resource management Find the best project team and forecast resourcing needs. Governance & administration Configure and manage global controls and settings. Portfolio management at scale Deliver project consistency and visibility at scale. Content management Organize, manage, and review content production.

- Or alternatively re-send them the invoice by itself with a gentle reminder that it is due now if the Customer is late in paying.

- If you fall into any of these categories – budding bookkeeper or an experienced one trying to switch to self-employment – you are at the right place.

- When I tried changing my business type to all the other options, there weren’t equivalent features.

- Information provided on Forbes Advisor is for educational purposes only.

- For example, let’s say you spend about five hours a month on bookkeeping, and your average hourly rate is $75.

- The lower end of the range typically includes basic bookkeeping for a small business that only requires five or so hours of work per month.

Automatic categorization helps you find write-offs and save on taxes. Single-entry typically involves keeping just a Cash Book in which you list your Income and Expense cash or bank card payments. Single-entry is where each transaction is entered to just the one Account within the one Cash Book . Bookkeeping is the process of identifying the details of each transaction and recording them in an organized way into bookkeeping software for a 12-month period.

To be eligible for this offer you must be a new QBO customer and sign up for the monthly plan using the “Buy Now” option. This offer can’t be combined with any other QuickBooks offers. To cancel your subscription at any time go to Account & Settings in QBO and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice. The emergence of online bookkeeping software like FreeAgent has transformed the bookkeeping industry in the last decade, with bookkeepers now able to manage a business’s finances from almost any location.